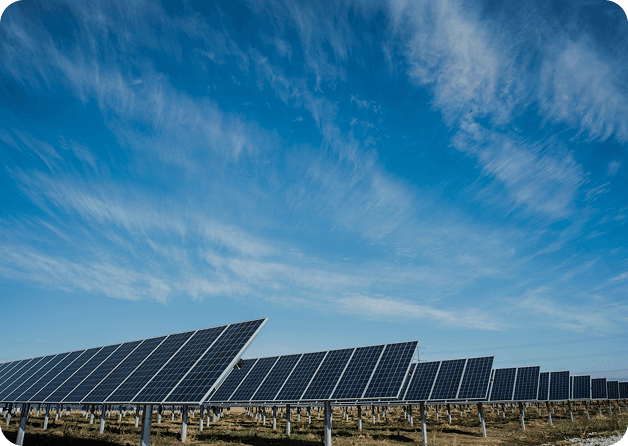

Renewable Energy Certificate operations today are handled across a patchwork of fragmented registries, spreadsheets, and manual processes. Teams manage multiple logins, switch between platforms to track inventory, transfers, and retirements, and manually reconcile discrepancies when registry data does not align. This limits real-time visibility into what is held, what is pending, and what has been finalized, increasing the risk of errors, missed obligations, and last-minute scrambles during reporting or compliance deadlines. Because REC programs, portfolios, and internal workflows vary widely by organization, tools that require teams to change how they operate often introduce friction, slow adoption, and create new operational gaps instead of eliminating them.

Innovo addresses these challenges with Solas, a unified operating platform purpose-built for REC operations. Solas connects directly to registries such as M-RETS, PJM, NEPOOL, EVIDENT, and others through Innovo's Registry Gateway, consolidating inventory across accounts and organizations into a single system of record. Registry data is normalized and enriched, enabling consistent filtering, tagging, bulk transfers, and retirements from one interface. By adapting to existing workflows rather than forcing process change, Solas reduces manual work, improves auditability, and allows teams to scale REC activity with greater confidence, without adding operational complexity or headcount.

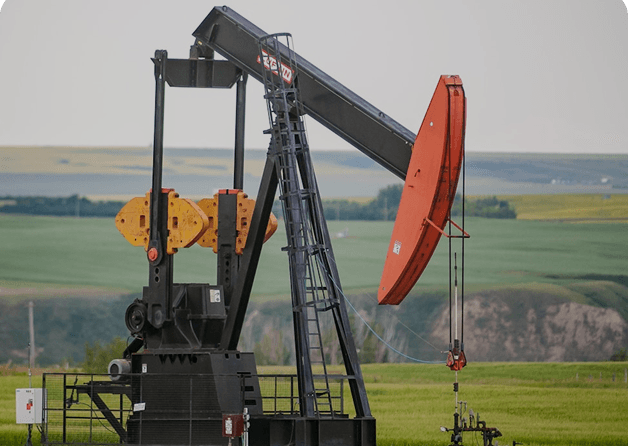

In oil and gas markets, royalty payment volumes are large and operational workflows are fragmented. Payments move through multiple handoffs across operators, revenue accounting, land administration, finance, and compliance teams, with settlement cycles commonly stretching 30 to 60 days or longer after production. Production data, ownership interests, payment calculations, and supporting documentation are managed across disconnected systems, making it difficult for royalty owners and operators to track payment status in real time. This lack of visibility increases operational overhead, ties up working capital, and introduces payment disputes and counterparty risk that scale with production volume and asset complexity.

Innovo addresses these challenges by providing an infrastructure layer built for high-volume royalty payment workflows. By linking production data, ownership records, payment calculations, and settlement events into a single operational workflow, Innovo captures each step as a structured, auditable event. By standardizing processes and enabling near real-time royalty settlement and reconciliation, Innovo reduces capital lock-up, shortens payment cycles, and improves transparency across operators and royalty owners. This shifts the market model from one dependent on manual reconciliation and delayed reporting to one where scale, speed, and trust are driven by shared infrastructure rather than operational effort.

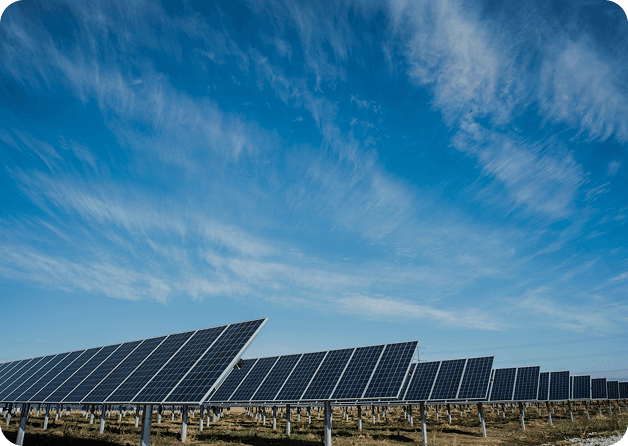

Carbon markets today operate without consistent operational infrastructure. Registries expose different data structures, asset metadata varies by standard and methodology, and critical information such as delivery intent, ownership context, and usage is often tracked outside the registry in spreadsheets or internal systems. As portfolios grow across projects, vintages, and standards, teams rely on manual reconciliation to understand asset status, eligibility, and retirement history. This fragmentation limits transparency, slows settlement and reporting, and makes it difficult to scale participation or support higher-integrity carbon use cases with confidence.

Innovo provides the foundation for a more scalable and auditable carbon market infrastructure. By abstracting registry-specific complexity and enabling standardized carbon data across systems, Innovo can support interoperable workflows between registries, trading platforms, and market participants. Assets can be organized using consistent metadata such as project, vintage, and methodology, with transfers and retirements recorded as structured, traceable events rather than off-system documentation. This infrastructure-first approach improves transparency and trust across financial, corporate, and regulatory stakeholders, creating the conditions for carbon markets to scale as standards evolve and market participation expands.